STRENGTHS

PILLARS THAT POWER SMARTWORKS

Our strengths enable us to deliver consistent results and sustain our leadership in the managed workspace industry. Over the years, we have evolved into a trusted name in the managed workspace industry through a sharp focus on scale, service excellence, and market responsiveness. A well-defined growth approach, backed by operational discipline and industry foresight, has strengthened our ability to deliver consistent value. Our platform is designed to adapt to shifting client requirements while creating sustainable, long-term benefits for all stakeholders.

MARKET LEADERSHIP

Smartworks is India’s #1 managed office platform, in terms of total stock, with a footprint of 11.79 Mn.* sq. ft. with a presence across 14 Indian cities and Singapore – a true national footprint with top 4 cities contributing ~75% of revenue. Our leadership in India’s managed campus segment is driven by scale, steady expansion, and a proven ability to deliver large, enterprise-grade workspaces across major business hubs. A strong pan-India footprint, value-focused pricing, and capability to lease and transform large properties make us the preferred partner for mid-to-large enterprises.

*Includes Term Sheet/signed LOIs

EXCEPTIONAL EXECUTION CAPABILITIES

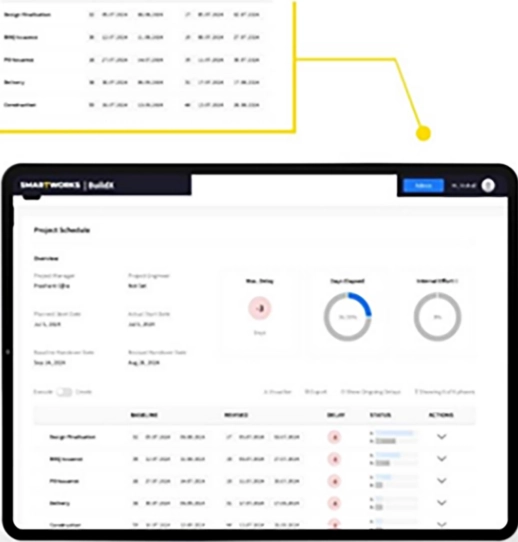

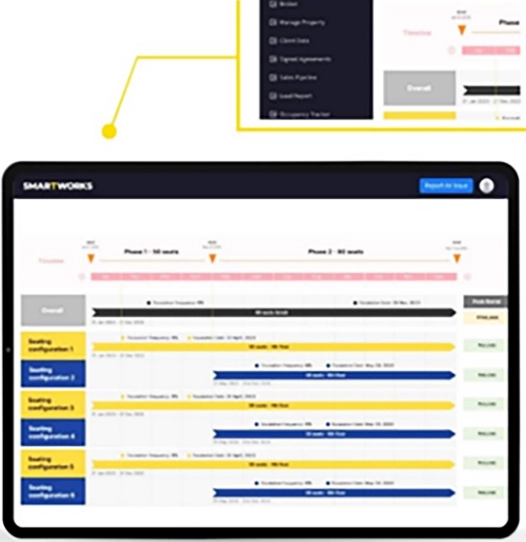

Our expertise lies in our exceptional execution capabilities. Leveraging our extensive design library, in-house design team, and a state-of-the-art, proprietary-tech platform called BuildX, we are able to deliver fully customised offices to our clients in just 45-60 days. We design, develop, and operate expansive, fully serviced environments that combine scale efficiencies with competitive leasing terms. The result is vibrant, high-quality workspaces that attract and retain enterprise clients while maintaining consistent standards across locations.

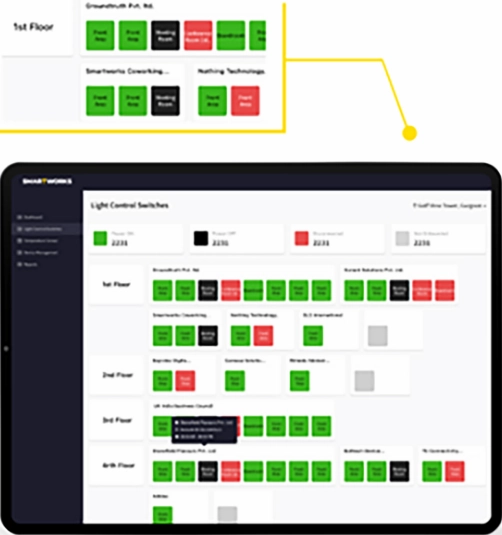

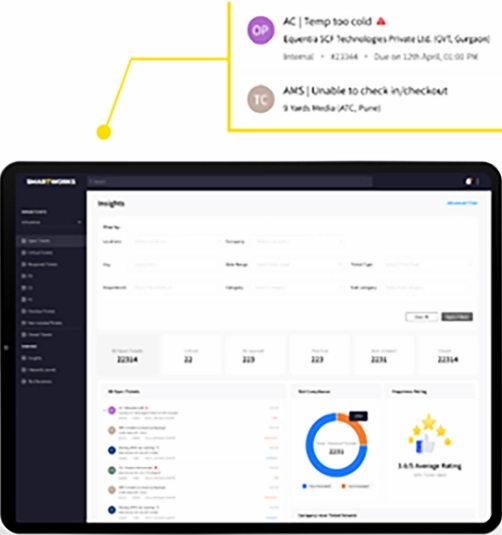

Powered by Tech

SW BuildX

CRM

BMS LCS

Ticketing Dashboard

COST LEADERSHIP

We maintain cost leadership and strong unit economics with Industry leading OPEX and CAPEX metrics leveraging tech-enabled execution capabilities. Our frugal mindset and operational agility are backed by process standardisation and tech integration, positions us to respond effectively to client needs while driving better terms and faster returns for clients. This cost leadership allows us to pass on savings, helping enterprises allocate more resources to growth and innovation.

₹ 34-36

OPERATIONAL COST PER SQ. FT. PER MONTH

₹ 1,350

FITOUT COST / SQ. FT.

UNIQUE AND DIVERSIFIED SUPPLY ACCESS

We have developed strong access to a wide and varied supply base, sourcing a significant share of our portfolio from city-linked regional promoters and landlords. This diversified approach enables us to cater to enterprises of all sizes, with a focus on customised solutions for mid-to-large clients.

~20%

PORTFOLIO SOURCED FROM INSTITUTIONAL LANDLORDS SUCH AS DLF, TATA REALTY AND RAHEJA.

DERISKED, INSULATED BUSINESS MODEL

Our business model combines effective asset-liability management achieving breakeven at ~65–70% occupancy in a centre, with a clear focus on mid-to-large enterprises, enabling longer lock-in periods and stronger retention. A strategic pricing approach ensures rental revenue remains at least twice the lease costs. Diversification across industries, regions, and clients reduces concentration risk. Long-term agreements with both landlords and clients provide resilience against cyclical fluctuations, supporting stable and sustainable growth. In fact, given our value pricing, we are the preferred partner for our clients during a downturn.

Mid-to-large Enterprise focus with longer lock-in period

~2x the rental expense is targeted for the rental revenue

≤30% SPACE TYPICALLY LEASED TO A SINGLE CLIENT IN LARGE CENTRES TO AVOID CONCENTRATION RISK

OUR ECONOMICS

Strong pre-fill occupancy commitment from existing or prospective clients

~65%-70% OCCUPANCY TO ACHIEVE BREAK-EVEN IN A TYPICAL CENTRE

~30-32 Months AVERAGE PAYBACK COMPARED TO 51-52 months FOR TYPICAL OPERATOR

Asset-liability mismatch eliminated till FY27

DIVERSIFIED INDUSTRY PORTFOLIO

Smartworks benefits from a well-diversified industry mix. By serving Clients across various growth sectors like information technology, engineering, insurance, energy, Ed-tech, e-commerce, fintech and consulting, we reduce concentration risk.

A majority of our Rental Revenue is derived from sectors other than information technology, technology and software development which contributed 57.72% of our Rental Revenue during Fiscal 2025.

ACTIVELY REDUCING PORTFOLIO CONCENTRATION RISK

We have made significant strides in minimising client concentration risk. The revenue contribution from our top 10 clients has dropped from 39% in FY 2018-19 to just 19% by FY 2024-25. This demonstrates our ability to scale the platform and broaden our client base, ensuring that our revenue streams are well distributed.

FINANCIAL AND CAPITAL EFFICIENCY

Our capital-efficient model delivers industry-leading payback periods, supported by prudent financial management and strategic execution. Fit-out investments follow a phased approach–building shared spaces first and customising work areas as clients sign on–minimising upfront costs. Use of client deposits and lease rental discounting strengthens cash flow, while advance rentals ensure consistently low receivable cycles and break even typically happens within the first 12 months.

Our business model, focused on enterprise clients, ensures long-term, annuity-like contracts with highly predictable cash flows from Forbes 2000 companies, global MNCs, Indian conglomerates, and well-funded startups. These aren’t just one-off deals–they’re stable, recurring revenue streams. Think of it like a REIT but with a host of office services such as design, fitouts, day-to-day operations and all amenities included - achieved through an asset-light, capital-efficient model.

Smartworks has delivered a marked improvement in financial efficiency, as reflected by improvement in Normalised Return on Capital Employed (ROCE).

STRONG AND COMMITTED LEADERSHIP

A blend of entrepreneurial vision and seasoned expertise drives our growth in the managed workspace industry. The leadership team brings deep capabilities across real estate, finance, operations, and strategy, supported by strategic investors. A stable senior management base enables cohesive decision-making and consistent execution of long-term business goals.

65.15% Promoter holding

We have achieved this scale with just ~ ₹ 5,000 Mn of raised Equity till Mar’25.